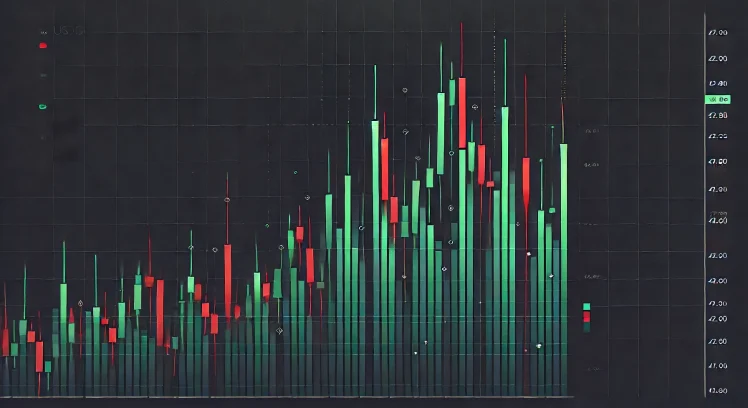

As of March 12, 2025, the USD/CHF currency pair is exhibiting a bearish trend, influenced by both technical indicators and fundamental factors. This article provides an in-depth intraday trading strategy, highlighting key technical levels, potential entry and exit points, and essential risk management considerations.

Market Overview of USD/CHF

The USD/CHF pair has been on a downward trajectory, with recent analyses indicating a continuation of this bearish sentiment. Technical indicators, such as moving averages and the Relative Strength Index (RSI), support this outlook.

Key Technical Levels of USD/CHF

-

Support Levels:

- 0.8778: Identified as the next immediate support level, a breach of which could lead to further declines.

- 0.8750: A critical support level that, if broken, may signal a continuation of the bearish trend.

-

Resistance Levels:

- 0.8900: A recently broken support level now acting as resistance, which could cap any short-term rebounds.

- 0.8924: A minor resistance level; surpassing this could temporarily neutralize the bearish bias.

Technical Indicators for USD/CHF Trading in Asian Markets

-

Moving Averages: Both simple and exponential moving averages (5, 10, 20, 50, 100, and 200 periods) are signaling a ‘Sell,’ reinforcing the bearish outlook.

-

RSI (14): The RSI is in the oversold territory, suggesting that while the bearish momentum is strong, a short-term correction could occur.

Intraday Trading Strategy for USD/CHF

Entry Point

Given the prevailing bearish trend, consider entering a short position when the price retraces to the resistance level at 0.8900. This approach allows for capitalizing on potential price reversals at established resistance points.

Stop-Loss Placement

To mitigate risk, place a stop-loss order above the next resistance level at 0.8924. This placement helps protect against unexpected bullish movements that could invalidate the bearish setup.

Profit Target

Set a profit target near the support level at 0.8778. This target aligns with the identified support, offering a favorable risk-to-reward ratio.

Risk Management

Implementing strict risk management is crucial in intraday trading. Risking no more than 1-2% of your trading capital on a single trade is advisable. Ensure that the position size is calculated to maintain this risk threshold, considering the distance between the entry point and the stop-loss level.

Fundamental Considerations

While technical analysis provides immediate trade signals, staying informed about fundamental factors is essential. Economic indicators from both the United States and Switzerland, such as GDP growth rates, employment data, and central bank policies, can significantly influence the USD/CHF pair. For instance, stronger-than-expected Swiss economic data could further strengthen the CHF, supporting the bearish USD/CHF outlook.

Conclusion

The USD/CHF pair is currently under bearish pressure, with technical indicators and support/resistance levels aligning to favor short positions. By entering at strategic resistance levels, setting appropriate stop-loss orders, and targeting realistic profit levels, traders can effectively navigate the current market conditions. Always adhere to robust risk management practices and remain vigilant of fundamental economic developments that could impact currency movements.